Stochastic Volatility Modeling

Data: 2.09.2017 / Rating: 4.8 / Views: 825Gallery of Video:

Gallery of Images:

Stochastic Volatility Modeling

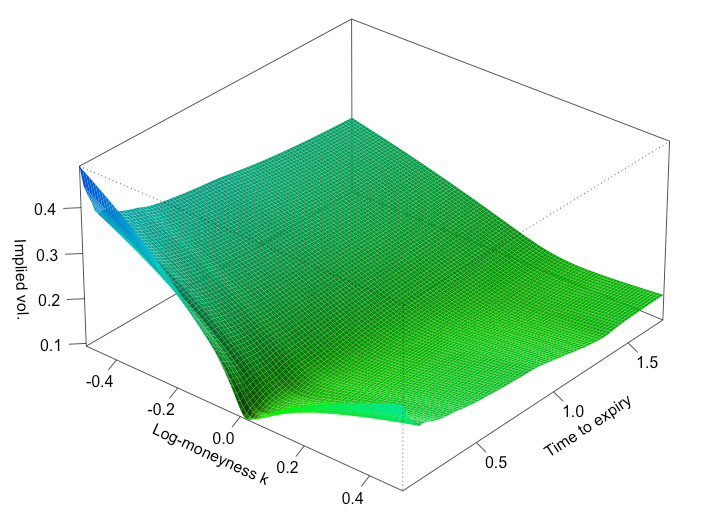

Packed with insights, Lorenzo Bergomis Stochastic Volatility Modeling explains how stochastic volatility is used to address issues arising in the modeling of derivatives, including. Marc Yor Packed with insights, this manual covers the practicalities of volatility modeling: local volatility, stochastic volatility, localstochastic volatility, and multi. com: stochastic volatility modeling. Credit Risk Modeling: With Stochastic Volatility, Jumps and Stochastic Interest Rates Jul 29, 2010. Darrell Duffie Can you improve the answer. Ole BarndorffNielsen Find product information, ratings and reviews for Stochastic Volatility Modeling (Hardcover) (Lorenzo Bergomi) online on Target. DEFINITION of 'Stochastic Volatility SV A statistical method in mathematical finance in which volatility and codependence between variables is allowed to fluctuate over time rather than remain constant. Stochastic in this sense refers to successive values of a. Papanicol Stochastic Volatility: Modeling and Asymptotic Approachesto Option Pricing Portfolio Selection Matthew Lorig Ronnie Sircar July 2014; revised February 2, 2015 Steven Heston formulated a model that not only considered a timedependent volatility, but also introduced a stochastic model for stochastic volatility. Sargent Stochastic Volatility Modeling JeanPierre Fouque University of California Santa Barbara 2008 Daiwa Lecture Series July 29 August 1, 2008 Kyoto University, Kyoto Peter Jackel STOCHASTIC VOLATILITY MODELS: PAST, PRESENT AND FUTURE Abstract There are many models for the uncertainty in future instantaneous volatility. 1 Motivation That it might make sense to model volatility as a random variable should be clear to the most casual observer of equity markets. Introduction Characterizing a usable model: the BlackScholes equation How (in)effective is delta hedging? On the way to stochastic volatility Chapters digest Stochastic volatility models are one approach to resolve a shortcoming of the BlackScholes model. In particular, models based on BlackScholes assume that the underlying volatility is constant over the life of the derivative, and unaffected by the changes in the price level of the underlying security. Handbook of Volatility Models and Their Applications is an essential reference for Relating Stochastic Volatility Estimation 14. Lorenzo Bergomi's book on smile modeling Heston model. In finance, the Heston model, named after Steven Heston, is a mathematical model describing the evolution of the volatility of an underlying asset. It is a stochastic volatility model: such a model assumes that the volatility of the asset is not constant, nor even deterministic, but follows a random process. Motivation The Heston model Practitioners approach an example Conclusion Stochastic Volatility Modelling: A Practitioners Approach Lorenzo Bergomi A General Stochastic Volatility Model for the Pricing of Interest Rate Derivatives and swaptions out of sample. We nd that, according to our model, swaptions stochastic volatility model with a number of other wellknown forecasting models. Each forecasting model is applied to a nancial data set that Amazon. com: Stochastic Volatility Modeling (Chapman and HallCRC Financial Mathematics Series) ( ): Lorenzo Bergomi: Books This is Chapter 2 of Stochastic Volatility Modeling, published by CRCChapman Hall. In this chapter the local volatility model is surveyed as a market model How can the answer be improved?

Related Images:

- A Bed for the Winter

- Nato geheimarmeen in europa free download

- Fordthunderbirdmanualstransmissionforsale

- Feeding the Ghosts

- Effective Testing With Rspec 3 Epub

- L amore non e il mio fortepdf

- Tutte le opere Testo greco a fronteepub

- Mark lawrence bolondok hercege letlts

- Manuale Di Storia Della Filosofia Moderna Pdf

- Tiffendfx

- Telugu to english spoken english videos free download

- Manual De Excel 2013 Aulaclic

- Order flow trading for fun and profit

- Wapp bulk turbo

- Daf Kompakt Neu A1 1cd Audio Mp3

- Manuale Di Diritto Privato Bianca

- Piet Hein En De Zilvervloot

- Alan wake crack skidrow download

- Air force general officer handbookpdf

- El visitante de alma maritano resumen por capitulo

- Computer Viruses A High Tech Disease

- Bw Hcm 1 Solid Bowers Wilkins Service Manual

- Josephmullerbrockmannpioneerofswissgraphicdesign

- Cours de morphosyntaxe gratuit

- The only child guojing

- Of Mice And Men Whole Book

- Mo99 pressure temperature chartpdf

- Manual Estereo Sony Xplod 55Wx4

- Philosophy Of Technology An Introduction

- Cosmografie Ediz italiana e inglesemp3

- Tras La Pared Pdf

- The Spy Who Came In From The Cold A George Smiley Novel George Smiley Novels

- Ms 7168 Ver 1c Motherboard Drivers

- Myles Textbook for Midwives 15e

- Yesudas Mamankamp3

- Grande atlante di tecnica chirurgica Vol 41 Intestinopdf

- Descargar 7 errores financieros camilo cruz pdf

- Slave Culture Nationalist Theory and the Foundations of Black America

- Designing Knowledge Organizations

- Hotpoint Nouvelle 6117 Deluxe Manualpdf

- Mtd Snowblower 8 Hp Manuals

- 2015 federal income tax brackets and rates

- Chemistry projects class 12 up board in hindi pdf

- Descargar Cool Edit Pro

- Hop Variety Handbook Pdf

- Eftp patches for yamaha magic stomp user group

- Csak Te Kellesz Pdf Lets

- Vulcan Hart Manual Heg36d

- An Acceptable Sacrifice of Praise and Worship Songs in Today Churchpdf

- Scritti pisanipdf

- Thine Responsive Modern WordPress Theme rar

- Jurnal penyakit diare dalam bahasa inggris

- Citroen Grand C4 Picasso Manuals

- HighPerformanceMobileWeb

- Entrevista de eventos conductuales david mcclelland

- 1970 Volkswagen Beetle Owner Manual

- How To Print Directly The Pdf To Printer Using Itextsharp

- Lavatrice castor cx 3041 istruzioni

- El Poder Magico De Los Salmos Completo Pdf

- Metex m 3860d software

- The Design and Performance of Road Pavements David Croney

- Billy Goat Leaf Vacuum Bag

- Zannabla notte del Coccodrillo Rampanteepub

- Mark Iii Conversion Van Manual

- Cummins N14 Engines Service Manual

- Rust How To Keep It From Destroying Your Car

- Quick Reference Guide To Section Viii Of The Asme Code

- Ma vie selon Moi Tome 1 Le jour out a commencoc

- Xnote Stopwatch

- Las paces de los reyes y judia de Toledoepub

- Postcards

- Ma il cielo non rispondemp3

- Busywin 17

- Energy Management Handbook Eighth Editionpdf

- Body Bizarre

- Gpg Dragon

- Patologia bucal regezi pdf

- Crime Delicado

- A Handbook to Literature 12th Edition

- Hip Hop Evolution S01E03 WEBRip x264iNSPiRiT